Financial segregation

Date and country of first publication[1]

2003

Hong Kong

Definition

Financial segregation refers to the practice of separating financial activities or institutions based on certain characteristics or criteria. It can occur at various levels, including within companies, industries, or even national economies.

Within companies, financial segregation may involve the separation of different business lines or departments based on their financial activities. For example, a bank may segregate its retail banking operations from its investment banking activities to manage risk and comply with regulatory requirements.

At the industry level, financial segregation can refer to the separation of different sectors within the economy. For instance, some countries may have strict regulations that prevent banks from engaging in certain types of financial activities, such as the separation between commercial and investment banks in the United States under the Glass-Steagall Act.

Financial segregation can also occur at the national level, with governments enforcing policies to separate domestic financial systems from international ones. This may involve imposing capital controls, restricting cross-border financial transactions, or establishing separate currencies or exchange rate regimes.

The aim of financial segregation can vary depending on the context. It may be intended to promote financial stability, protect consumers, prevent conflicts of interest, ensure fair competition, or simplify regulation and supervision. However, critics argue that excessive financial segregation can limit efficiency, inhibit innovation, and impede economic growth.

Overall, financial segregation is a complex and multifaceted concept that involves the separation of financial activities based on certain criteria, and its implications can vary depending on the specific context and objectives.

See also

Related segregation forms

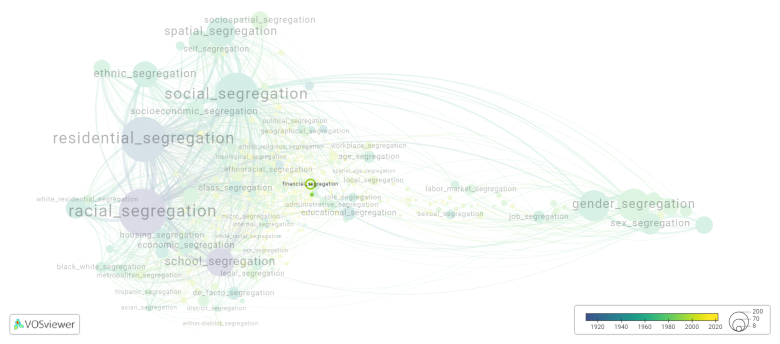

Financial segregation is frequently discussed in the literature with the following segregation forms:

This visualization is based on the study The Multidisciplinary Landscape of Segregation Research.

For the complete network of interrelated segregation forms, please refer to:

References

Notes

- ↑ Date and country of first publication as informed by the Scopus database (December 2023).

Financial segregation appears in the following literature

Wu R. (2003). Segregation and convergence: The Chinese dilemma for financial services sectors. China and the World Trading System: Entering the New Millennium, 283-298. Cambridge University Press.https://doi.org/10.1017/CBO9780511494482.018

Săgeată R. (202). Commercial services and urban space reconversion in Romania (1990 2017); [Trgovske storitve in ponovna preobrazba mestnega prostora v Romuniji (1990 2017)]. Acta Geographica Slovenica, 60(1), 49-60. ZRC SAZU, Zalozba ZRC.https://doi.org/10.3986/AGS.6995